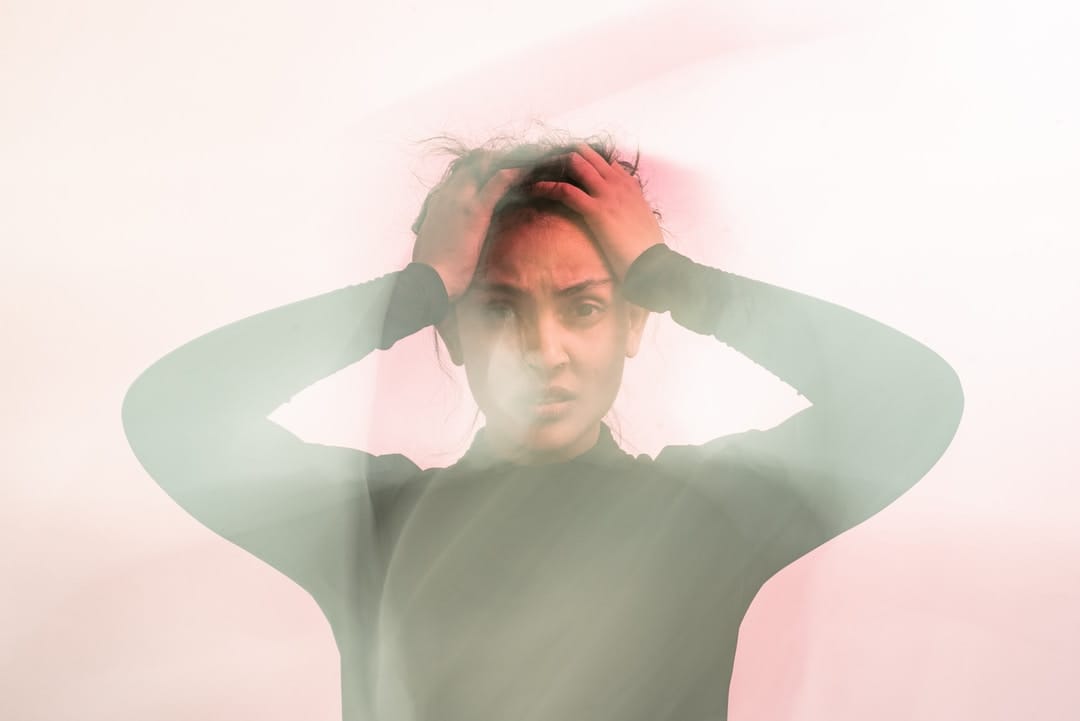

Anyone who’s ever really struggled with money understands the direct link between financial worries and mental health. Even if you don’t have an anxiety disorder, there’s a clear connection between concerns about basic needs being met and mental wellness. Unfortunately, this often boils down to a lack of money, a low online bank account balance, maxed-out credit cards, and the inability to be approved for a mortgage or small business loan. Like it or not, the ability to create opportunities and buy yourself peace of mind is often directly connected to money. To better understand the connection between mental wellness and that bank account balance, read on.

Anxiety and Basic Needs

Few would disagree that it’s hard to have great mental wellness when you’re worried about where your next meal is coming from, whether you have gas in your car, or if you can make rent. For someone constantly checking their banking account, they can be thankful that online banks Canada is an option when it comes to ease of use and financial management. If you’re dealing with financial pressure and anxiety, turn to Wealth Rocket to find the best online banks with good interest rates that don’t require a minimum balance. A good mobile banking app from a commerce bank can help you reach your financial goals.

If you are struggling with making the bills, lost a job to COVID-19, haven’t felt like yourself lately, or are constantly worried about money, you may have developed a perfectly natural anxiety disorder given the circumstances. Someone like you might want to reach out to a therapist for help. There are free and income-based therapists online and in every major city. Start with a Google search for a low-cost therapist near you or reach out to your doctor.

Taking a Break From Pressure

If you’re struggling, it’s important to take a break. Attending one of the top mental health retreats could be important if you’re experiencing hopelessness or suicidal ideation or struggling with substance abuse due to your financial issues. Not only will you learn how to manage your stress and begin to unravel your root issues, but you’ll have a chance to take a break from the daily worries of making bills on time. In fact, you’ll leave with an aftercare plan that could include budgeting, subsidized housing, job placement help, or more.

Striking Balance: Living Above and Below Means

It can be difficult to live within our means no matter who we are or what our financial picture looks like. Learning to live with only what you can afford is a great way to help your own mental health. Start with taking a look at what you’re financially responsible for and making cuts where you can. While this may be difficult, the mental health payoff will be worth it.

At the end of the day, few things are as important as our physical and mental health. Because of this, self-care is important, especially if you’re worried about finances and your online bank balance. The truth is we’re all more valuable than money, and whether or not you can get therapy to manage your stress around finances, it’s a good idea to do what you can to find a balance between work and play. While you may be tempted to work overtime to fix your financial concerns, you’ll be more productive at work if you plan on time for relaxation. Something as simple as fitness classes or yoga classes could give you the motivation to take on your financial worries one bill at a time.

The ability to find balance in anything you do, including decisions about your income and budgeting needs, can lead to better mental health overall and a happier you. When weighing your financial concerns against your pocketbook, always remind yourself of your own worth. Your mental health doesn’t have a price tag.