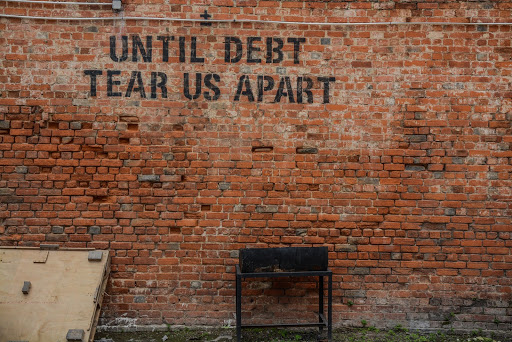

No-one likes having debt. It can be stressful at the best of times but during a pandemic our anxiety is already heightened, so it’s only natural that watching the bills roll in or seeing your account drop into the negatives would have a bigger impact on your emotional state.

Luckily, you do have options – everything doesn’t have to be storm clouds and woe. Below we’ve outlined some paths that you can take to help stabilize your financial health in these uncertain times.

Looking Into Loans

Although it can be tempting to roll your daily expenses under a single payment when they’re starting to get away from you, ‘solutions’ such as payday loans or credit cards can simply take you from the frying pan and place you in the fire.

Schemes and plastic often come with high-interest rates and outrageous repayment terms which, in the long run, will leave you worse off than where you started. If you really need to borrow to get yourself through, look into payday loan alternatives. They tend to have lower interest rates and almost certainly offer far better conditions on repayments.

Hit Pause

Luxuries such as magazine subscriptions and streaming platforms can quickly chew through your budget. Each plan may not seem like much on its own, but when you add it all up to a monthly total, you’re probably looking at a fairly hefty sum.

We’re not saying you have to get rid of everything indefinitely, but if you’re struggling, it can be wise to pause your subscriptions. Even just cutting your subscriptions down to one from each type (tv, music, magazine, etc) can make a huge difference in times like these and may even keep you out of debt.

Seek Government Assistance

There’s no shame in asking for help when you need it, and the government stimulus packages were created to assist the community and economy. If you’re worried about what you see when you check the bank, you almost certainly fit the criteria for at least some form of assistance. Look into what’s available in your area and send in an application. The worst they can say is ‘no’ but if you get a yes, things should be a bit easier to manage.

Redo Your Budget

It may also be time to sit down and look over your outgoing expenses. When we look closely, it often becomes apparent that many things we consider essential are actually luxuries. While this is generally fine, if debt is an issue you’re concerned about, it may be a wise idea to trim the fat. Make a budget, or if you already have one, reassess it.

Get Professional Help

If you’re finding that it’s too hard to get things back on track on your own, see if there are any free or low-cost financial advisors that you can work with, either in your local area or online. People in this field are specially trained to assist with even the trickiest financial dramas. So, they’ll be able to help you come up with a plan that will provide the best possible outcome.

Debt is obviously something that you want to avoid if possible, but you don’t need to freak out just yet. There are strategies and paths, like those listed in this article, that can help you get things sorted before they get the chance to snowball. The most important thing is to remember not to panic. You got this.